A recent development has captured the interest of both cryptocurrency investors and analysts. The remarkable surge in demand for spot Bitcoin ETFs (exchange-traded funds) within the United States, coupled with the anticipated reduction in the rate of new BTC entering circulation following the forthcoming halving event, is poised to trigger a substantial supply shock that could fundamentally transform the cryptocurrency market.

As speculation heats up, experts weigh in with compelling theories that offer insight into the future of Bitcoin’s price and its implications for the global economy.

Theory 1: Bitcoin ETF Inflows Driving Demand

Marc van der Chijs, a Dutch entrepreneur and global investor with a keen eye on the cryptocurrency market, offered an insightful analysis of Bitcoin in light of recent developments in ETFs and the anticipated effects of the Bitcoin halving event. His observations provide a granular look into the market demand, supply constraints, and the potential price trajectory of Bitcoin.

Van der Chijs highlighted the significant impact of Bitcoin ETF inflows on the cryptocurrency’s price. He noted a direct correlation between these inflows and daily price increases, attributing a 2% rise in Bitcoin’s price to ETF-related demand. This is particularly noteworthy during the pre-market settlement periods in the United States, where announced inflows tend to push the price higher preemptively.

One of the intriguing aspects of van der Chijs’s analysis is the identification of a “market inefficiency.” This inefficiency arises from the predictable nature of price increases following the announcement of ETF inflows. Van der Chijs acknowledged the potential for profit in trading this pattern, underscoring the impact of ETFs on Bitcoin.

Van der Chijs further delved into the supply-demand imbalance exacerbated by ETF inflows. He pointed out that the demand from ETFs significantly outstrips the supply of newly created Bitcoin. Therefore, it creates a situation where prices are forced upwards as sellers hold out for higher prices.

This imbalance is expected to intensify with the upcoming halving of Bitcoin mining rewards. It will reduce the daily supply of new Bitcoin by half, further amplifying the supply shock.

“I think we are in uncharted territory here, but I believe an average increase of $1,000 per trading day over the next weeks is very likely… This means that unless there is a black swan event, we will see a new all-time high before the halving, and we could possibly hit $100,000 in the next 2 to 3 months already,” van der Chijs explained.

Theory 2: Underestimated Global Wealth Flow

Andrew Kang, co-founder of Mechanism Capital, offered a broader perspective on Bitcoin’s potential growth. He highlighted the underappreciated scale of global wealth and its flow into cryptocurrencies. Kang’s analysis estimates long-term Bitcoin demand driven by the massive aggregate income and wealth worldwide.

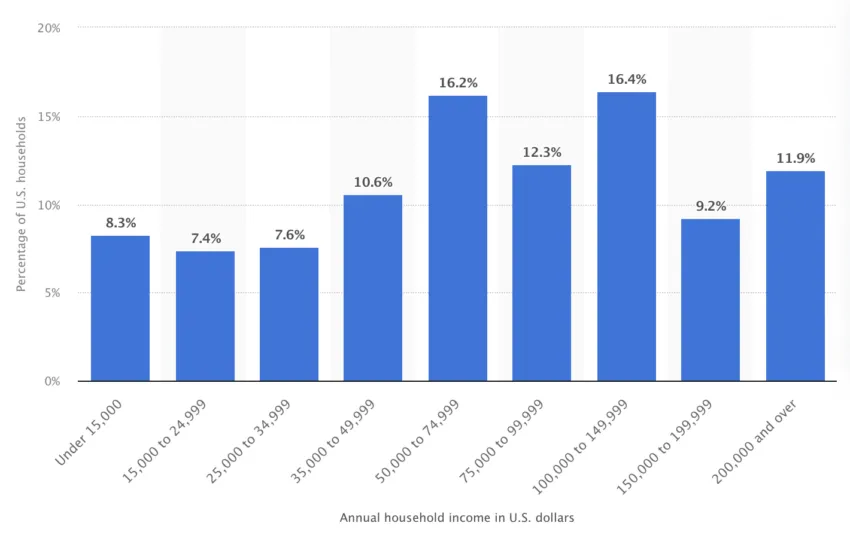

Kang used the average US household income as a starting point to extrapolate the global aggregate income. He suggested a staggering $52 trillion in potential investment power worldwide. This figure underscores the vast reservoir of capital that could flow into cryptocurrencies, far beyond what many investors might currently perceive.

Even with a conservative estimate of a 1% annual allocation of global income to Bitcoin, this translates to approximately $52 billion in buying power for BTC annually, or $150 million daily. This estimate does not account for the higher allocations that enthusiasts and institutional investors are likely to commit.

Read more: Bitcoin Price Prediction 2024/2025/2030

Kang also touched on the transformative effect of Bitcoin ETFs on the market. Before the approval of these ETFs, there was already a consistent demand for Bitcoin, which contributed to its rise as a trillion-dollar asset. The introduction of ETFs is expected to increase this demand further. Especially as daily inflows have exceeded initial estimates, hinting at a potential for even greater daily investment sums.

“I still believe this ETF launch is not comparable to previous events like CME futures, Coinbase IPO, etc. And we don’t spend any time below $40,000. [We will see] $50,000 to $60,000 in February, and an [all-time high] by March,” Kang said.

Theory 3: The Long-Term Institutional Inflow

Ric Edelman, the founder of the Digital Assets Council of Financial Professionals, brought a forward-looking perspective on the influx of institutional and individual advisor investments into Bitcoin, particularly through ETFs. His argument is built around anticipating a significant shift in financial advising, focusing on the role of digital assets.

Edelman highlighted that independent financial advisors, who collectively manage about $8 trillion in assets, are increasingly interested in allocating a portion of their portfolios to Bitcoin ETFs. This shift indicates a broader acceptance and recognition of digital assets’ potential to diversify investment portfolios and enhance returns.

Citing industry surveys by the Digital Assets Council of Financial Professionals and Bitwise, Edelman noted that three-quarters of advisors are willing to allocate to Bitcoin ETFs. This consensus among advisors reflects a growing confidence in digital assets’ stability and future growth despite their inherent volatility and the nascent regulatory framework governing them.

By doing simple arithmetic based on the surveys, Edelman forecasted more than $150 billion in total inflows into digital assets by the end of 2025. This figure is derived from an average allocation of 2.5% of assets under management by 77% of independent advisors.

Such a substantial influx of capital would validate the cryptocurrency market as a mainstay in investment portfolios and potentially drive up the price and liquidity of Bitcoin significantly.

“I’m anticipating that by the time we get to the end of 2025, we’re talking 2 years, we’re going to see total inflows of more than $150 billion. We’re only at $5 billion right now,” Edelman said.

Collectively, these three theories underscore a significant trend. The Bitcoin supply shock is a reflection of deeper economic forces at play.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment