Bitcoin, cryptocurrency’s flagship coin has been a grey area in relation to both monetary and macroeconomic factors. Different regulators, such as the New York Federal Reserve, deep-dive into this relationship and the after-effects the asset class may or may not possess.

Various factors, including monetary and macroeconomic news, influence Bitcoin’s price. While it is true that Bitcoin is a relatively new and distinct asset class, it is still subject to many of the same market forces as traditional asset classes.

For example, when there is news that suggests inflation is rising or the value of the U.S. dollar is falling, this can cause investors to turn to Bitcoin as a potential hedge against inflation and a store of value. However, there have been a few questions asked on this topic.

Conversely, positive economic news, such as solid job growth or a rising stock market, can lead investors to shift away from Bitcoin and towards more traditional assets. Furthermore, Bitcoin has been known to experience significant price swings in response to regulatory announcements or changes in government policy. For example, when China banned cryptocurrency trading in 2017, the price of Bitcoin dropped significantly.

Understanding the Relationship

While Bitcoin may not be directly correlated with all traditional asset classes, it is still subject to many of the same market forces, including financial and macroeconomic news. To shed more light on the relationship, the Federal Reserve Bank of New York published a report analyzing the impact of macroeconomic factors on the price of Bitcoin.

The FED report titled “The Bitcoin–Macro Disconnect” discussed the disparity between the behavior of Bitcoin and the macroeconomic factors that typically affect traditional asset classes. The report notes that Bitcoin has shown little correlation with measures of economic activity such as inflation, interest rates, and economic growth. Additionally, Bitcoin has exhibited higher volatility than other assets, with significant price swings occurring in short periods.

The cumulative crypto market capitalization hit $2.50 trillion in 2021, with Bitcoin’s market value reaching $1 trillion. Fast forward, BTC suffered a significant correction last year. Nonetheless, different macro factors influenced BTC’s past price action. To assess this, the authors analyzed specific macro factors affecting the price. In other words, they considered BTC’s price action when it appeared to be directly related to a macro factor, not some crypto-specific factor like the collapse of FTX.

Crypto and Market Manipulation

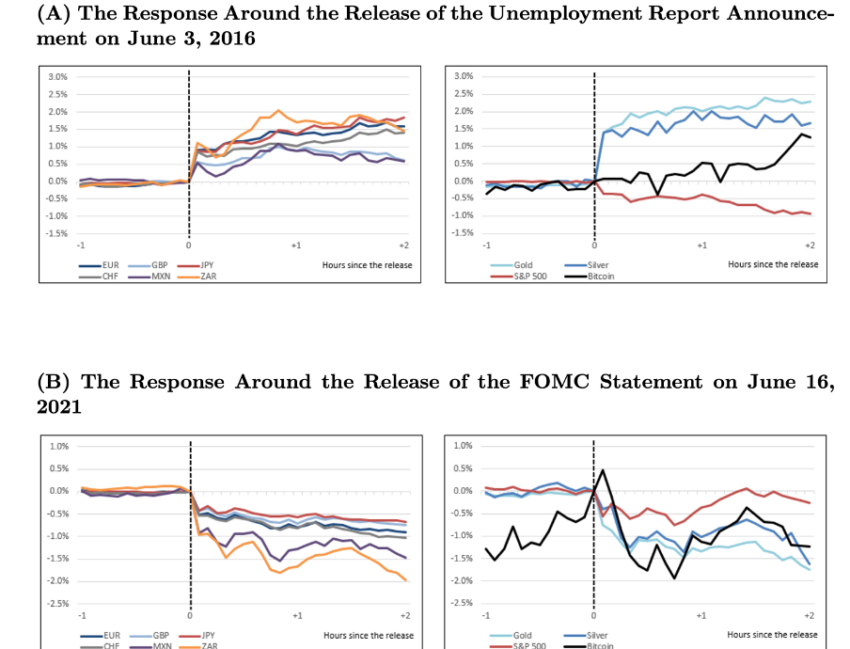

Therefore, the report divided these macro factors into three categories: news about the real economy and unemployment statistics. News about inflation, such as the Consumer Price Index or CPI, and information about monetary policy, such as a change in interest rates or the Fed’s intention to change rates in the future.

The authors specified that they looked at how BTC’s price responded to these macro factors between 2017 and 2022. This is because BTC reached a “more mature stage” starting in 2017. This seems to reference the launch of Bitcoin Futures on the Chicago Mercantile Exchange used by institutions in late 2017.

Many asserted that this launch of the Bitcoin Futures on the CME is when institutions started manipulating the crypto market. Market manipulation has since extended to other cryptos, namely Ethereum (ETH), which is now also on the CME.

Macro Factors Defined

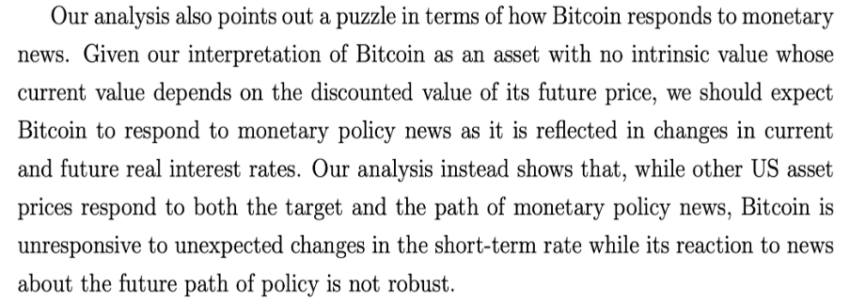

The report then unpacks how the authors modeled BTC as a speculative asset with no intrinsic value. It states that BTC price is determined by interest rates which are in turn determined by macro factors. For context, debt becomes cheaper and easier to borrow when interest rates are low. This increases the total money supply, which causes prices to rise.

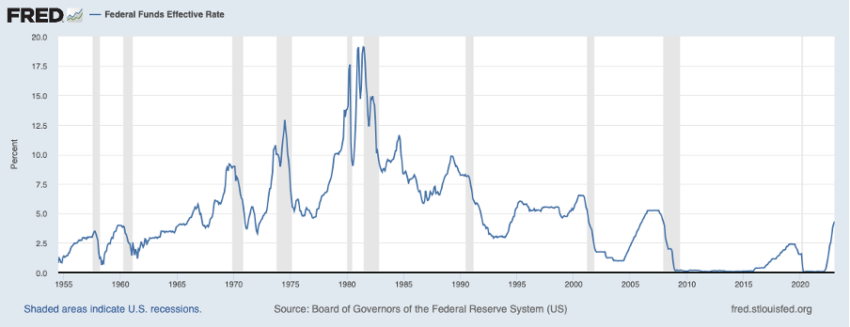

Interest rates have remained low since 2008, which was reflected in multiple asset classes appreciating. When interest rates are high, debt becomes more expensive and harder to borrow. This decreases the total money supply, which causes prices to decline. This has been the case since the Fed announced it aimed to raise rates in Nov. 2021. The catch is that the Fed started raising rates in the spring of 2022.

Nonetheless, the markets reacted because investors would want to capitalize on potential effects, always pricing on what will happen in the future. Recall that this forward guidance is one of the three macro factors the authors included in the report. This leaves unemployment and inflation. These are relevant to interest rates because most central banks have been explicitly instructed to ensure that both unemployment and inflation stay low.

Inference from the Report about Bitcoin

In the case of the Fed, the unemployment and inflation target stands somewhere around the four percent and two percent mark, respectively. Central banks, too, act upon the guidance and achieve this dual mandate by changing interest rates. Higher interest rates result in lower inflation but higher unemployment, and vice-versa. This is why investors have been anxiously awaiting every single inflation statistic – lower inflation means that the Fed will lower interest.

(Increased money creation can trigger some increase for the financial market, especially risk assets like BTC.)

Speaking to one of the authors, Carlo Rosa shared a key screenshot with BeInCrypto. It read:

Bitcoin is orthogonal to monetary and macroeconomic news. “This disconnect is puzzling as unexpected changes in discount rates should, in principle, affect the price of Bitcoin even when interpreting Bitcoin as a purely speculative asset,” the author added.

Bitcoin, compared to other Asset Classes

The largest cryptocurrency market cap grew from $1 billion in 2013 to over $1 trillion in 2020. The average annualized return since 2012 was almost 3x per year. By contrast, the average annualized return for the S&P 500 was just 11% per year. During the same period, gold and silver remained flat.

The Fed accepts the need for more study to comprehend the mismatch between Bitcoin and macroeconomic issues. According to the research, “the finding that Bitcoin does not respond to monetary news is intriguing since it raises some concerns about the significance of discount rates in pricing Bitcoin.”

On the other hand, following the report, social media platforms such as Twitter saw multiple reactions. Here’s one of the reactions:

Overall, according to the Fed report, Bitcoin and cryptocurrencies are seen as speculative assets that are still maturing compared to other asset classes. Only time will tell whether BTC will be a contender to the U.S Dollar.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment