The retail trading boom of the past year has shown signs of slowing down. Retail traders, who made a big impact on the stock market in the first two years of the Covid-19 pandemic, are now facing steep losses.

According to JPMorgan Chase & Co, retail traders’ returns are down by around 40% in 2022. The share of such investors in US equity market volumes has also declined by 40% since the start of 2021. High-flying technology stocks have seen a significant drop in popularity, with the ARK Innovation exchange-traded fund down 63% this year.

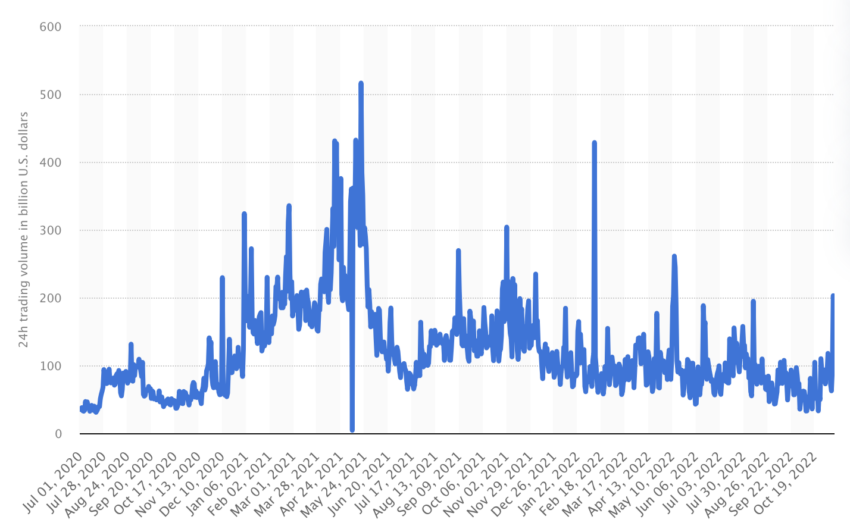

While the slowdown in retail trading activity has been observed in traditional stock markets, the question remains whether this trend extends to the crypto market.

Capitalizing on Market Opportunities

Many retail traders have run out of resources, maxing out their credit cards and facing a lack of government relief payments and savings.

The market conditions have changed, with central banks raising interest rates and the cheap money that fueled markets for over a decade drying up. Meme stocks such as GameStop and Bed Bath & Beyond, which were stars in 2021, are now nursing double-digit losses. Robinhood Markets, the no-fee app used by many retail traders, has also seen its own stock plummet by 75%.

But what does this mean for the crypto market? The rise of cryptocurrencies has been fueled, in part, by retail investors, who have flocked to digital assets as a way to diversify their portfolios and take advantage of the high returns they offer. However, the recent dip in the crypto market, which saw many cryptocurrencies lose over 50% of their value in just a few days, has made some retail traders wary.

Despite these ups and downs, the crypto market has continued to attract new traders and investors, drawn to the promise of fast profits and the potential for long-term gains. The rise of decentralized exchanges, non-custodial wallets, and other innovative financial tools have made it easier than ever for individuals to participate in the crypto market.

So, has the cult of the retail trader fizzled in the crypto market as well? The answer is a bit more complicated than a simple yes or no.

Optimism Reigns Among Crypto Traders

The number of new retail traders entering the crypto market has slowed. There are several reasons for this shift.

For one, the market has become more volatile and challenging, as rising interest rates and increased regulatory scrutiny have made it more difficult for individual traders to make consistent profits. Additionally, many traders have realized that the high stakes and rapid-fire trading that characterized the boom was not sustainable and could result in significant losses.

Still, the market remains vibrant and dynamic, with a large and dedicated community of individual crypto traders and investors. The crypto market is unique in many ways, and it’s difficult to make broad statements about the behavior of retail traders in this market.

Cryptocurrencies are still in the early stages of development and adoption, and the market is likely to continue to evolve and mature in the coming years.

While the slowdown in retail trading activity observed in traditional markets may be reflected in the crypto market to some extent, it’s important to remember that the crypto market is its own beast, with its own set of rules and dynamics. The future of retail trading in this market remains to be seen, but one thing is clear: the crypto market will continue to be shaped by the actions and decisions of individual traders and investors.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

Be the first to comment